Europe - peach and nectarine crop estimates.

2021-05-28 10:23

Source:

www.fresh-market.pl

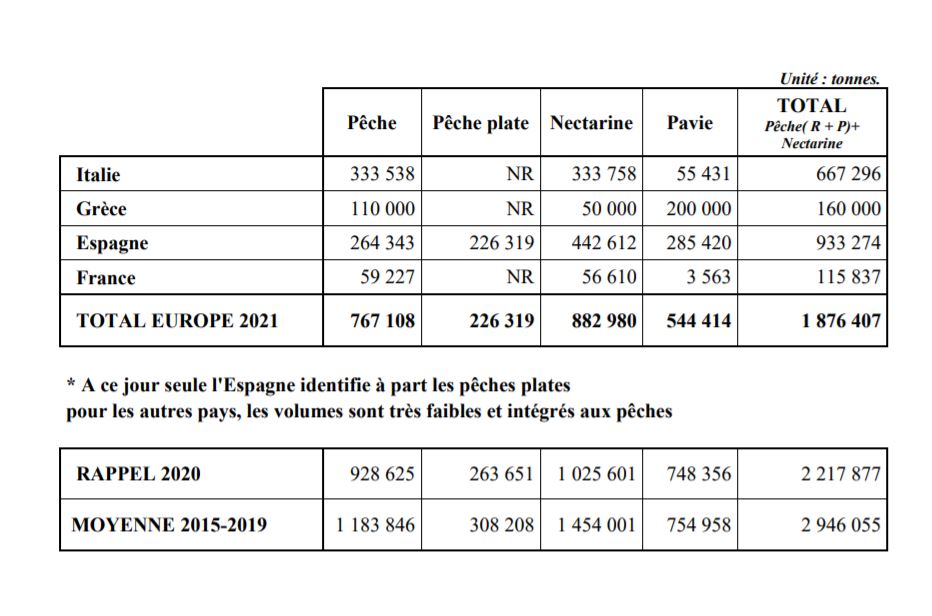

Peach and nectarine yield forecasts for the four main growing countries, Greece, Spain, Italy and France, were presented yesterday during the third and final medFEL webinar.

The 2020 European harvest, which has already suffered from crop shortages, is expected to be the smallest in the last 30 years. 2020 was marked by the COVID crisis and a yield deficit of almost 2.3 million tonnes of peaches, flat peaches and nectarines; 750,000 tonnes compared to 850,000 tonnes in 2019 for Pavia peaches (yellow peaches), a total of just over 3 million tonnes.

In 2021, the production shortfall does not spare any growing area - almost 1.9 million tonnes of peaches, flat peaches and nectarines are expected to fall, 15 per cent less than in 2019 and 36 per cent less than the 2015/2019 average. Pavia yields are also expected to fall by 544,000 tonnes, -27 per cent compared to 2020 and -28 per cent compared to the average of the last five years. In total, the European harvest in 2021 is expected to be 2.4 million tonnes.

Greece

With a total of 690,000 tonnes in 2020 (185,000 tonnes of peaches, 105,000 tonnes of nectarines and 400,000 tonnes of Pavia), the forecast for 2021 is 360,000 tonnes. 110,000 tonnes of peaches, half the normal year, and 50,000 tonnes of nectarines, compared with 120,000 to 130,000 tonnes in a normal year. This is down 45 per cent from last year and 47 per cent from the 2015/2019 average. Pavia peaches are forecast to be harvested this year at 200,000 tonnes, down 50 per cent from 2020 and 46 per cent from the 2015/2019 average.

France

The 2020 season was already characterised by bad weather conditions (frost and rain) with yields of 180,000 tonnes (including Pavia), i.e. 11 per cent less than in 2019, but the crop suffered even more in the 2021 season, especially due to frosts in early April. The Rhône Valley was the most affected area with temperatures down to -7°C, as well as the PACA region and Languedoc-Roussillon. Forecast for 2021. This is 115,000 tonnes, down 34 per cent from 2020 and 42 per cent from the 2015/2019 average.

Italy

In 2020, frosts in late March and early April affected crops in Italy. The northern regions of Italy were particularly affected, as well as the central and southern regions along the Adriatic coast. The result was a historically low harvest in Italy in 2020 with just over 750,000 tonnes of peaches and nectarines, i.e. -35 per cent compared to 2019, with a particularly pronounced deficit in the Emilia-Romagna region, where losses amounted to almost 75 per cent. This year, frost has once again affected all growing areas, from north to south. The yield forecast is even lower, at 667,000 tonnes, 11 per cent less than in 2020, which was already very bad, and 45 per cent lower than the 2015/2019 average. The difference with 2020 seems limited, but it should not be forgotten that 2020 was already a record year for small yields in Italy.

Spain

The 2020 harvest in Spain was just over 1,000,000 tonnes of peaches, flat peaches and nectarines, 18 per cent less than in 2019. Most growing areas were affected by frost and hail. Spain's harvest is expected to fall in 2021 due to frost damage. This shortfall is due to a general decline in all growing areas and is expected to reach almost 930,000 tonnes of round peaches, flat peaches and nectarines, 7 per cent less than in 2020 and 25 per cent less than the 2015/2019 average. Pavia is expected to yield around 285,000 tonnes, 3 per cent less than in 2021 and 4 per cent less than the 2015/2019 average. Frost in the second half of March affected more than 16,000 hectares of peaches in Spain, including 6,000 hectares in Aragon, 5,000 in Catalonia and 3,000 in the Murcia region, with losses of up to 100 per cent on some plots, according to ENESA. (Entidad Nacional de Seguros Agrarios).

The 2021 season therefore seems very weak compared to the harvest potential and previous years. However, we will have to remain alert to further developments and the calendar, but it is certain that there will be a supply shortage this year.

Add comment

Commentary option available only for users with a subscription purchased