How did imports affect cherry prices in the summer of 2024?

The domestic cherry season of 2024 has already ended some time ago. This year, like in previous years, controversies arose among market participants due to the issue of cherry imports during the peak of the domestic campaign. The Central Statistical Office (GUS) has already published data on foreign trade in the summer months, allowing us to look at these numbers to assess the scale of this year's cherry imports during the peak of the domestic campaign. A similar analysis was conducted last year (here), providing material for comparison.

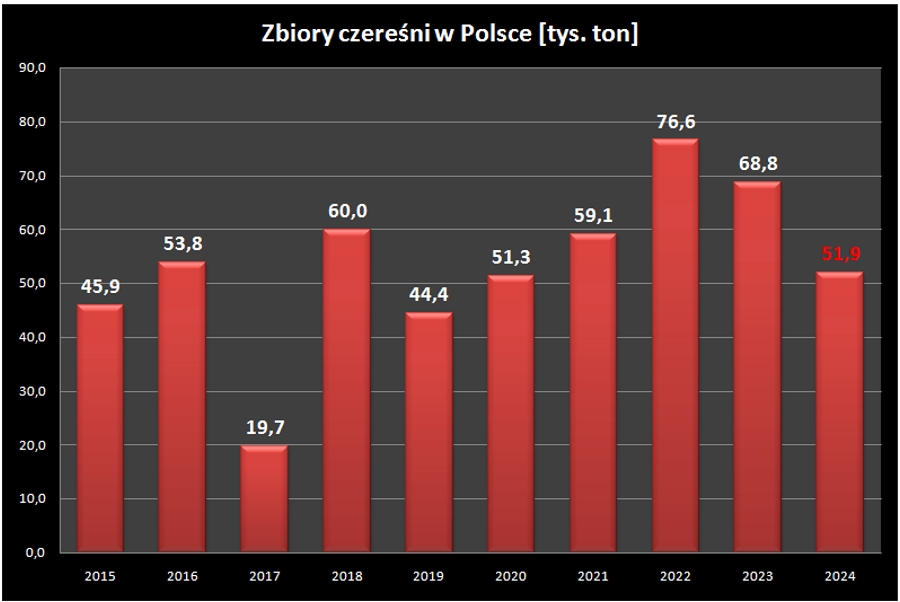

The Polish cherry season starts around the end of May and beginning of June, but it gains momentum in June. The availability of domestic cherries quickly increases in the domestic market, leading to a dynamic drop in wholesale prices. To what extent does this drop depend on factors beyond the increase in domestic production? And what was the level of production?

source: own elaboration based on GUS data

year 2024 - estimated data

The drop in cherry harvest in Poland this year was significant. According to the latest GUS estimates, it reached one-fourth of the volume harvested the previous year. This was expected to significantly impact the rise in cherry prices in the Polish wholesale market. And it did.

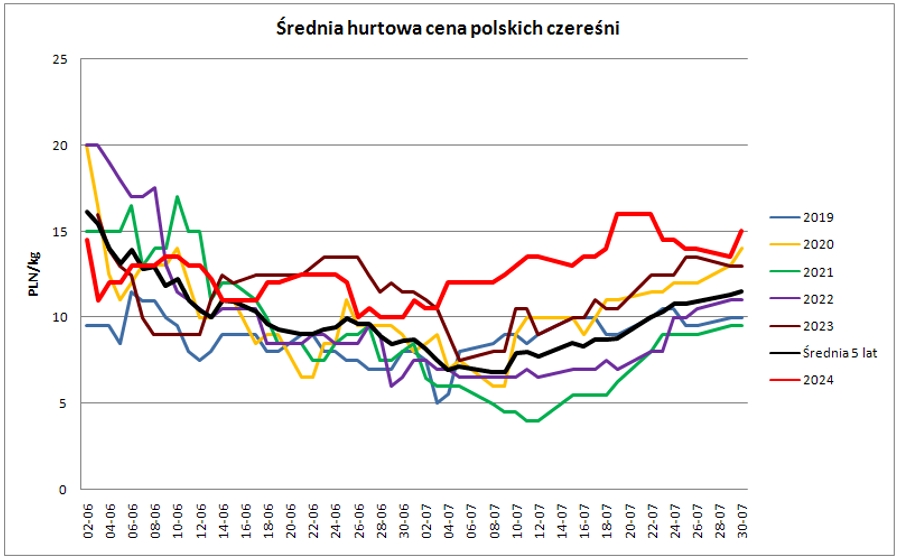

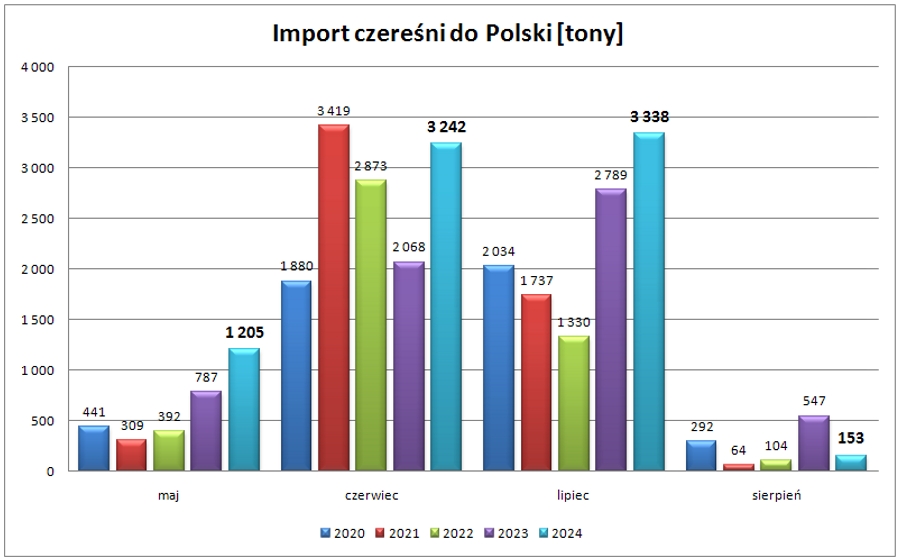

However, there are some "buts" in this correlation: lower harvests - higher prices. Analyzing GUS data on foreign trade in fresh cherries, especially import data, we see that this correlation was periodically strongly disrupted by the significant import of these fruits.

source: own elaboration based on GUS data

Firstly, volumes. As seen, there is a clear year-on-year increase from May to July. August, however, shows a decline. We also see the highest import in the last 5 years combined in the May-August period. In 2024, it was 79 tons, a 28% increase from the previous year and 69% higher than the import in the same period in 2022.

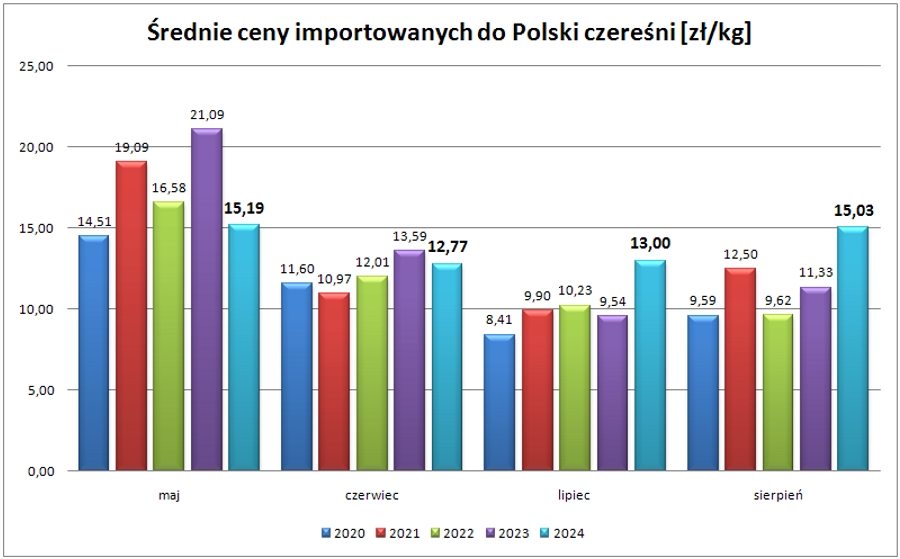

source: own elaboration based on GUS data

How were import prices during this period? The chart shows that at the beginning of the Polish season, imports were cheaper than in previous years. Prices only rose in July, especially in August (the main reason for the decline in import volume in August).

Here we clearly see the impact of high and relatively cheap imports on the Polish cherry market. Our domestic fruits had a very weak start to the season in May and June, inadequate to the low supply. Only later, when the pressure of imports decreased and the prices of imported cherries significantly increased, did domestic fruits begin to gain momentum.

Where were the most cherries imported from to Poland in the May-August 2024 period? Below is a table with volumes, also based on GUS data.

|

Turkey |

2,874 |

|

Germany |

1,649 |

|

Greece |

1,234 |

|

Serbia |

1,114 |

|

Spain |

579 |

Additionally, low harvests and consequently poor supply resulted in very weak exports of Polish fresh cherries in the discussed period. From May to August, Poland exported only 570 tons of cherries according to GUS data, amounting to 7.9 million PLN, with an average price of 13.88 PLN/kg. The average import price during the same period was 13.28 PLN/kg.