Is there a price revival coming in the potato market?

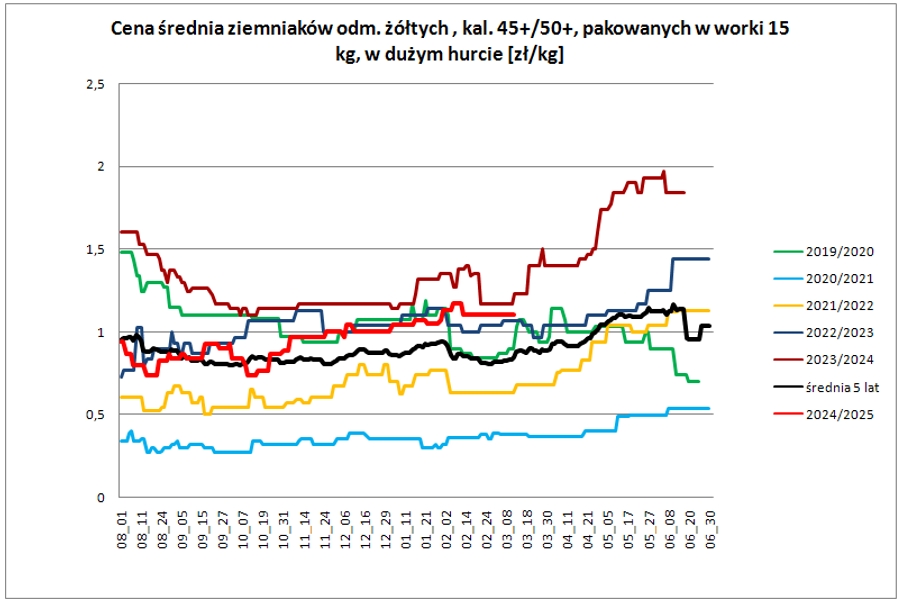

February brought a decrease in wholesale prices of Polish potatoes. In wholesale, the average selling prices of yellow and red varieties dropped by 6 percent. It is difficult to call it a true "price dip" that we see in February, during the winter holiday period, as was the case last year, as shown in the chart below.

The problem is not that prices dropped in February, but that they still do not show a tendency to recover from that loss. In wholesale, we still have a fairly stable situation with steady demand, limited influx of imports, and unchanged prices. Selling prices in wholesale remain in the range of 0.93-1.27 PLN/kg, depending on the variety, caliber, and region of the country. Of course, quality is also crucial.

It is worth noting that last year the beginning of the second decade of March already initiated an upward trend, and potato prices started to rise from the low point. What about now? Will we see a revival? So far, we do not see any signs of it, but experience teaches us that the situation can change almost overnight. Undoubtedly, it would help if a similar upward trend were to activate in other markets. How does it look?

Italians report stable prices ranging from 0.60-0.70 euro/kg in wholesale (up to 0.80 euro/kg for potatoes packaged in bags). The German market is also relatively calm and stable price-wise for now. Only minimal upward movement can be seen locally. Market prices range from 40-65 euro/100 kg, depending on the region of the country, variety, and caliber. Import from France is significantly more expensive, with prices ranging from 100-152 euro/100 kg.

Recently, there has been a slight downward trend in potato prices in Ukraine. According to east-fruit.com data, potatoes have decreased in price from 20-25 UAH/kg to 18-25 UAH/kg (still more expensive than last year when the average was 20 UAH/kg).

The situation in Russia looks much worse because there is a very low supply of potatoes, and the country had to double its potato imports year-on-year. The prices of domestic potatoes on the Russian market are already at 62 rubles/kg, and imports are even more expensive - up to 100 rubles/kg, or about 1 euro/kg (data from www.altra.ru). However, the situation in Russia only indirectly affects the EU market. Russia primarily buys these vegetables from Egypt or possibly from Asia, but even in Central Asia, there is a shortage of potatoes. In Kazakhstan, prices are rising, and the country is increasing imports and releasing stocks from the state reserve.

Returning to Ukraine, as this country is crucial for our potato exports, the information from there is clear. Prices are under pressure, but it is temporary, caused by the presence of lower-quality potatoes in the market. Stocks, especially of high-quality goods, are very low, and Ukraine will increase imports.

Therefore, the situation in the east will favor a rise in potato prices, and this should eventually translate into the situation in our market. Especially since imports from the West will not be high and will not be particularly cheap. Revival in the potato market is coming, although prices are unlikely to start rising dynamically tomorrow or the day after.