Will potato prices in Poland rise again?

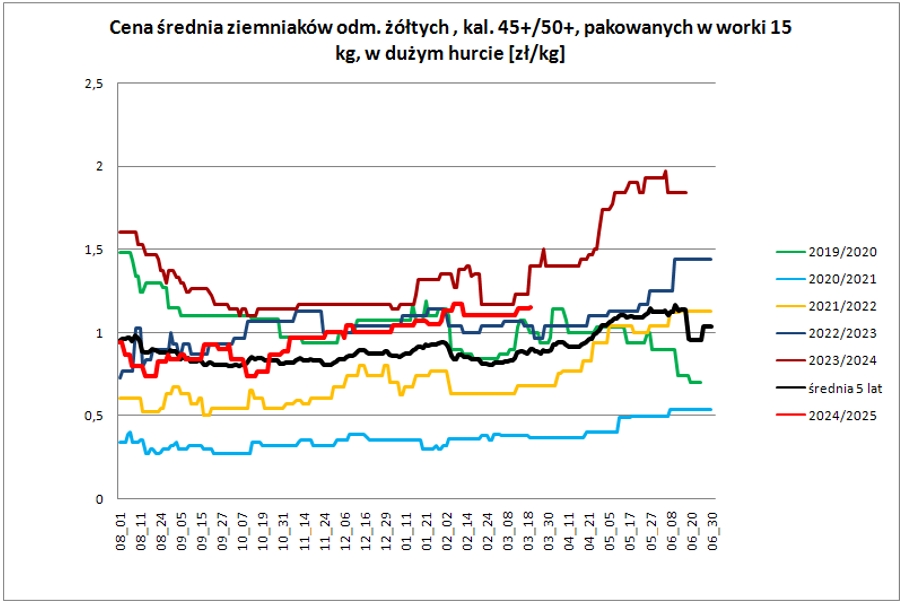

Starting from the second decade of February, throughout the whole month, we experienced a kind of price dip in the wholesale potato market. It wasn't deep, as in large wholesale prices dropped by around 6 percent on average, but a discount is a discount.

Is the situation in the edible potato market finally ripe for a change? In large wholesale, we have recently noticed a certain trend towards strengthening prices of yellow and red varieties of potatoes. Prices have risen especially for 50+ potatoes and those of high quality, with nice skin and healthy flesh. It is evident in the market that there is not much of such goods available.

Currently, the selling prices of these varieties of potatoes in large wholesale stand at 1.00-1.30 PLN/kg (approximately 0.24–0.31 EUR/kg), although there are still offers below one złoty, but for smaller quantities, smaller sizes, and lower quality. However, it should be noted that the recent price increases for potatoes are only about 4.5 percent and have not yet offset the earlier losses.

It seems, however, that a return to a long-term upward trend is feasible. Such trends are emerging in other European countries (although, for example, in NEPG countries, price drops were deeper than here). Furthermore, we are experiencing a return to frosty weather, which affects the growth of early potatoes under covers. Additionally, the latest data from GUS on potato exports and imports in Poland are very optimistic.

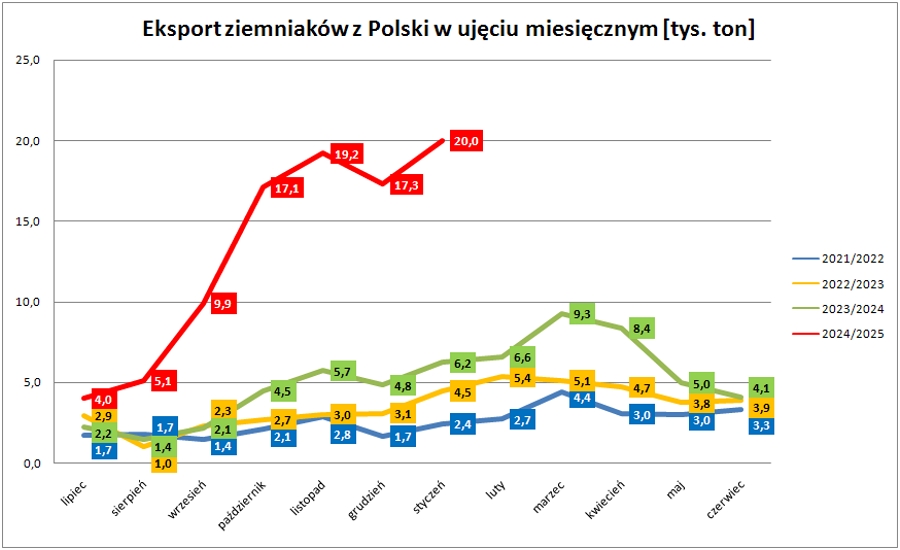

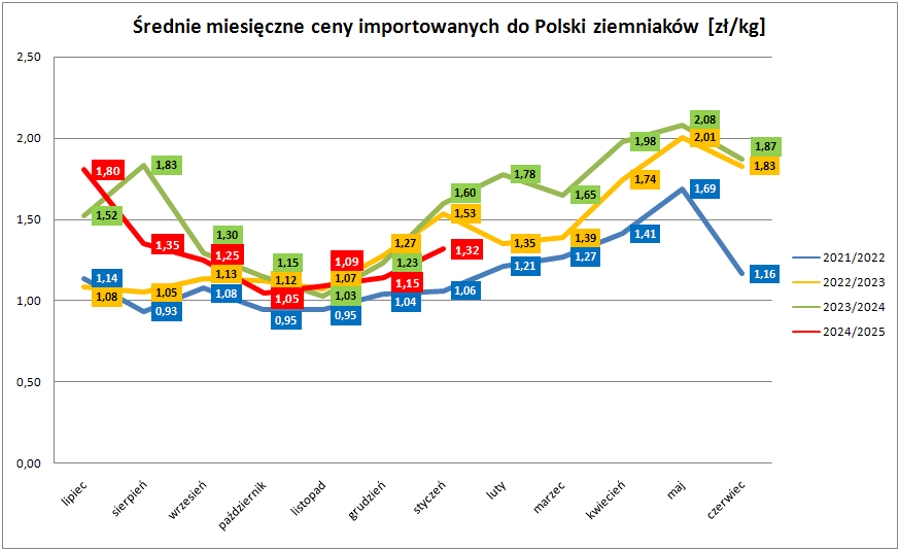

source: own elaboration based on GUS data

source: own elaboration based on GUS data

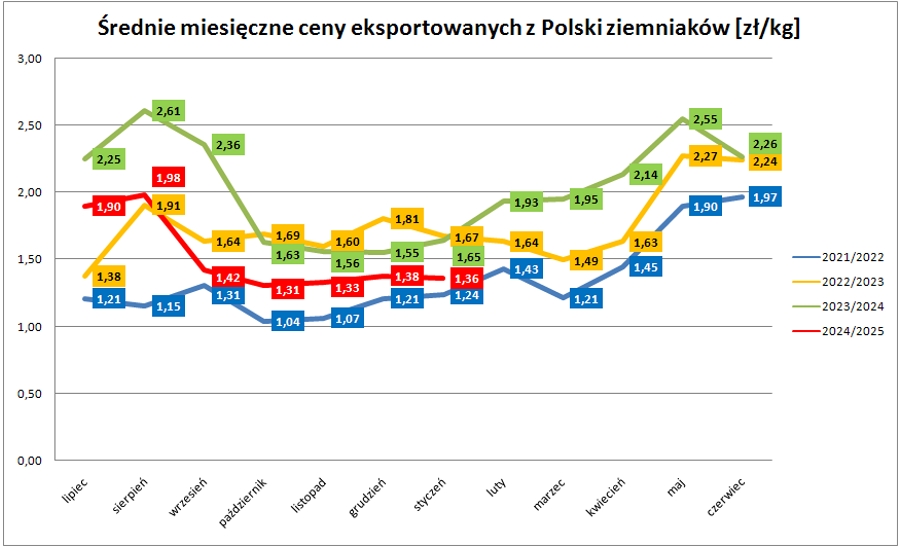

As seen, in January, after a December decline, exports significantly increased again. It was +16 percent month on month and a whopping +221 percent year on year. However, the average export price continued to decrease, but this time the month-on-month change was -11 percent compared to a -14.5 percent decrease in December compared to November.

Ukraine remains the largest recipient of Polish potatoes, with Polish exports to this country increasing to 8.6 thousand tons in January (compared to 6.2 thousand tons in December). Exports also grew to other key recipients: to Romania, it amounted to 5.8 thousand tons in January (compared to 2.4 thousand tons in December), to Moldova 1.6 thousand tons (compared to 1.4 thousand tons the previous month), and to Germany 1.4 thousand tons (compared to 0.6 thousand tons).

source: own elaboration based on GUS data

source: own elaboration based on GUS data

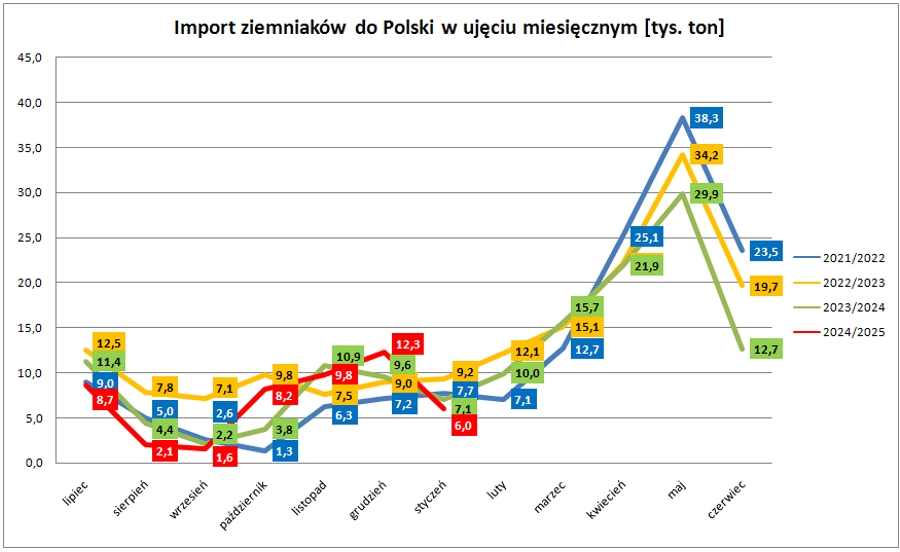

On the contrary, the situation was different with potato imports to Poland. Despite a significant increase in the average price (+4 percent in January compared to a 16 percent decrease in December), we saw a clear decrease in the volume of potatoes imported to our country. In January, there was a whopping 51 percent less compared to December and 16 percent less compared to January 2024.

The largest and dominant supplier of potatoes to the Polish market in January were Germany with a volume of 5.1 thousand tons (compared to 10.8 thousand tons in December). The second country on the list was Cyprus, but in January, less than 0.3 thousand tons (exactly 270 tons) of early potatoes were imported from there. The third place was occupied by the Netherlands, but with a very small volume compared to Germany, with just 254 tons.